Corporate Profile

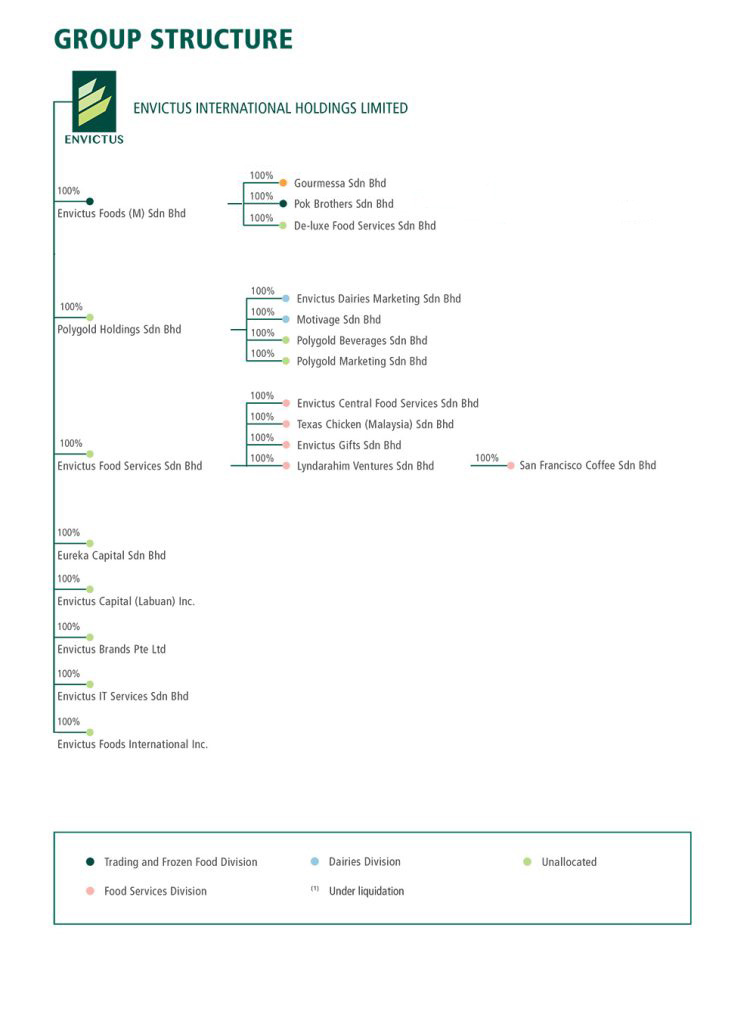

Listed on SGX Catalist (previously known as the SGX-SESDAQ) on 23 December 2004 and upgraded to the Mainboard on 18 June 2009, Envictus International Holdings Limited (“Envictus” or “the Group”), is an established Food and Beverage (“F&B”) Group. The Group has an established portfolio of businesses and brands operating under its key business divisions. Founded in 1997, the Group started as a manufacturer and distributor of sweetened condensed milk and evaporated milk, and in the years following its listing, has evolved into a diversified F&B player following several acquisitions.

In June 2014, the Group unlocked shareholders’ value in the business through the disposal of its investment in the Dairies and Packaging divisions and relevant intellectual properties to Asahi Group Holdings Southeast Asia Pte. Ltd. In 2018, the Group returned to the dairies business with the selling and distribution of sweetened creamer and evaporated creamer supplied by third party manufacturer. In June 2018, the Group completed the acquisition of Motivage Sdn Bhd which had a manufacturing licence to produce dairy products including sweetened creamer and evaporated creamer. This acquisition was to realise the Group’s plans for setting up of its own dairy manufacturing plant. In 2020, as part of the Group’s streamlining efforts, Envictus announced the cessation of an indirect wholly-owned subsidiary, The Delicious Group, which operated the Delicious restaurants. The Group also announced the disposal of its Nutrition Division by disposing off business and assets of a wholly-owned indirect subsidiary, Naturalac Nutrition Limited.

The Group’s business divisions currently comprise Trading and Frozen Food, Food Services (Texas Chicken and San Francisco Coffee) and Dairies. Envictus has operating facilities in Malaysia. Apart from Malaysia, the Group’s products can also be found in other countries including Africa, China, Indonesia, Japan, Singapore, Vietnam and the Philippines. The Group’s products are traded under various brand names such as SuJohan and San Francisco Coffee. Helmed by a management team of industry veterans who possess a wide range of expertise in strategic planning, business development, operational and production skills, the Group is well-positioned to tap on its solid foundation in the F&B industry to further enhance its established brand names.

Corporate Milestone

On 31 January 2022, De-luxe and Polygold Beverages entered into revised SPAs with Aryzta to reflect earlier completion date.

On 4 February 2022, SGX rejected the waiver application for shareholders’ approval for the proposed disposals and approved the Company’s request to seek shareholders’ approval for proposed disposals by way of a ratification resolution at an Extraordinary General Meeting (“EGM”). The disposal of business, factory, machineries and equipment of De-luxe and land by Polygold Beverages to Aryzta was completed on 11 February 2022.

At the EGM held on 5 August 2022, the shareholders approved the proposed ratification of the disposals.

On 20 May 2022, Texas Chicken (Malaysia) Sdn Bhd and Cajun have renewed its Franchise Agreement to extend the Franchise period with the exclusive right to develop 115 restaurants in Malaysia from 2022 to 2030 whereas exclusive right to develop 10 Restaurants in Brunei is from 2022 to 2029. Each restaurant is given a 10-year period to operate from the date of opening with an option to renew for another 10 years.

The following agreements were entered into on 31 March 2021.

a) A manufacturing, operations, supply and purchase agreement between De-luxe Food Services Sdn Bhd (“De-luxe”) with Aryzta Food Solutions Malaysia Sdn Bhd (“Aryzta”)

b) A conditional option plant and equipment purchase agreement (“SPA”) between De-Luxe with Aryzta for sale of De-luxe’s factory with all its machineries and equipment for RM76 million

c) A conditional option sale and purchase agreement (“SPA”) between Polygold Beverages Sdn Bhd and Aryzta for the sale of land on which De-Luxe’s factory is situated on for RM12 million.

OCTOBER

On 8 October 2021, Aryzta issued a Letter of Intent relating to its intention to bring forward the potential purchase of the property and assets ahead of the option granted under the option SPAs.

JANUARY

Change of name of whollyowned subsidiary, Glenland Sdn Bhd, to Envictus Central Food Services Sdn Bhd with effect from 9 January 2018.

MAY

Polygold Beverages Sdn Bhd, a wholly-owned subsidiary of the Company, entered into a conditional sale and purchase agreement with Hinoki Beverages Sdn Bhd on 7 May 2018 for the sale of its interest in two plots of land and factory buildings in Seremban and the plant machinery, lab and other equipment and motor vehicles situated on the properties for RM15.3 million. The disposal was completed on 27 June 2018.

JUNE

Signed an International Multiple Unit Franchise and Development Agreement with US-based Cajun Global LLC on 12 June 2018 forexclusive rights to develop and operate Texas Chicken restaurants in territories in parts of West Java, Jakarta, Banten, Lampung, South Sumatra and Bengkulu in Indonesia for 10 years from 2018 to 2027.

An EGM was held on 8 June 2018 to obtain shareholders’ approval on the proposed acquisition of Motivage as a major transaction and an interested party transaction. The allotment and issue of 15,775,210 consideration shares at an issue price of S$0.3913 was made as part satisfaction of the consideration for the proposed acquisition. The acquisition was completed on 21 June 2018.

JUNE

On 18 June 2018, the Company proposed a renounceable nonunderwritten rights issue of up to 113,534,799 new ordinary shares of the Company at an issue price of S$0.16 for each Rights Share with up to 113,534,799 free detachable warrants. Each warrant carries the right to subscribe for 1 ordinary share in the capital of the Company at an exercise price of S$0.16 for each Warrant Share, on the basis of 4 Rights Shares for every 5 existing ordinary shares in the capital of the Company.

Change of name of indirect wholly-owned subsidiary, Dominade Marketing Sdn Bhd, to Envictus Gifts Sdn Bhd with effect from 27 June 2018.

OCTOBER

An EGM was held on 19 October 2018 to obtain shareholders’ approval on the allotment and issue of the Rights Shares, the Warrants and the Warrant Shares.

NOVEMBER

At the close of rights exercise on 21 November 2018, valid acceptances and valid excess application for a total of 105,195,904 Rights Shares with Warrants, representing approximately 92.66% of the 113,543,799 Rights Shares with Warrants available under the Rights cum Warrants Issue were received. This amounts to net proceeds of approximately S$16.53 million.

March

Incorporation of new subsidiary in Indonesia, PT Quick Service Restaurant (“PTQSR”) on 21 March 2017 following the subscription of its shares by the Company’s wholly-owned subsidiaries, Envictus QSR Pte Ltd and Envictus Capital (Labuan) Inc. PTQSR is principally engaged in fast food restaurant business.

October

Change of name of its wholly-owned subsidiary, Polygold Foods Sdn Bhd to Envictus Dairies Marketing Sdn Bhd (“EDMSB”), with effect from 17 October 2017. The principal activity of EDMSB is to serve as a distribution company for sales and marketing of dairy food and beverages.

De-luxe Food Services Sdn Bhd, a wholly-owned subsidiary of the Company entered into a conditional sale and purchase agreement with Marco Flagship Sdn Bhd and Wong Ng Moh Tian @ Wong Moh Tian on 30 October 2017 for the sale of:

- 100% of the issued and paid-up share capital in Family Bakery Sdn Bhd; and

- 100% of the issued and paid-up share capital in Daily Fresh Bakery Sdn Bhd with the intellectual property rights of ‘Family’ and ‘Daily Fresh’ brands for RM1.5 million.

The disposal was completed on 18 December 2017.

November

Polygold Holdings Sdn Bhd, a whollyowned subsidiary of the Company entered into a conditional share sale agreement on 15 November 2017 for the proposed acquisition of 100% of the total issued and paid-up shares of Motivage Sdn Bhd for a consideration of RM24 million, to be satisfied by a combination of cash and the allotment and issuance of 15,775,210 shares in the capital of the Company.

February

On 12 February 2016, the Company completed its share consolidation exercise of every five existing issued ordinary shares into one ordinary share in the capital of the Company for compliance with minimum trading price of S$0.20 as a continuing listing requirement for issuers listed on the Mainboard of SGX-ST.

March

Platinum Appreciation Sdn Bhd (“PASB”) completed 85% acquisition of the entire issued and paid-up share capital of LVSB on 28 March 2016.

June

Change of name of wholly-owned subsidiary, Platinum Appreciation Sdn Bhd to Envictus Food Services Sdn Bhd with effect from 21 June 2016.

August

Envictus Food Services Sdn Bhd increased its shareholding in LVSB from 85% to 100% on 19 August 2016 by acquiring the balance of 15% from Brothers Coffee Ventures Sdn Bhd.

September

Incorporation of new subsidiary company in Singapore known as Envictus QSR Pte Ltd on 6 September 2016 for investment holding purposes.

November

Envictus Food Services Sdn Bhd, a wholly-owned subsidiary of the Company acquired The Delicious Group Sdn Bhd (“TDGSB”), which is engaged in the business as a café and restaurant operator on 30 November 2016.

Jan

The Group proposed to undertake an internal group restructuring exercise to streamline its Trading and Frozen Food and Others Divisions.

April

Polygold Beverages Sdn Bhd, a whollyowned subsidiary of the Company, entered into a conditional Sale and Purchase Agreement on 17 April 2015 for the proposed acquisition of eight plots of 99-year leasehold land, expiring on 24 February 2097 in Selangor Halal Hub, Pulau Indah with Central Spectrum (M) Sdn Bhd.

Jun

The Group structure was reorganised as follows:- a) Envictus Foods (M) Sdn Bhd (“EFMSB”) has transferred 100% of its equity interest in Family Bakery Sdn Bhd to De-luxe Food Services Sdn Bhd (“DFSSB”) on 1 June 2015 b) EFMSB has transferred 100% of its equity interest in Hot Bun Food Industries Sdn Bhd to Platinum Appreciation Sdn Bhd on 1 June 2015 c) Pok Brothers Sdn Bhd has transferred 100% of its equity interest in DFSSB to EFMSB on 1 June 2015 d) The Company transferred 100% of its equity interest in Polygold Beverages Sdn Bhd to Polygold Holdings Sdn Bhd on 18 May 2015 e) The butchery business of DFSSB was transferred to Gourmessa Sdn Bhd on 8 January 2015 f) EFMSB has transferred 100% of its equity interest in Daily Fresh Bakery Sdn Bhd to DFSSB on 23 June 2015

July

Eureka Capital Sdn Bhd, a wholly-owned subsidiary of the Company, entered into a Sale and Purchase Agreement on 24 July 2015 for the proposed acquisition of property with a 99-year lease expiring on 26 May 2067 located at 11, Jalan 225, Petaling Jaya, 46200 Selangor from Continental Oasis Sdn Bhd to cater for future office space requirement.

Oct

Completed the acquisition of leasehold property on 29 October 2015 with the delivery of legal and vacant possession of the property to Eureka Capital Sdn Bhd.

Nov

On 5 November 2015, the Company completed acquisition of 92,676,600 ordinary shares representing 11.43% of the total issued and paid-up share capital of Yamada Green Resources Limited, a company listed on the Mainboard of SGX-ST. This company is a major grower, manufacturer and supplier of fresh and processed agricultural products in Fujian Province, the People’s Republic of China. PT Sentrafood Indonusa, a whollyowned subsidiary of the Company, entered into a conditional Sale and Purchase Agreement on 11 November 2015 for the proposed disposal of its land and building to PT AKS Kawarang Timur. Acquisition of a shelf company, namely Dominade Marketing Sdn Bhd by EFMSB on 17 November 2015. Its principal activity is wholesaling and trading of food products. Change in number of shares held in Yamada Green Resources Limited (“YGRL”) by the Company from 92,676,600 ordinary shares to 18,535,320 ordinary shares on 24 November 2015 following the completion of share consolidation of every five existing shares into one consolidated share. The percentage of the total voting shares held by the Company in YGRL remained unchanged at 11.43%. On 26 November 2015, the Company proposed a consolidation of every five existing issued ordinary shares in the capital of the Company into one ordinary share in the capital of the Company for compliance with minimum trading price of S$0.20 as a continuing listing requirement for issuers listed on the Mainboard of SGX-ST.

Feb

Increased equity holding in Etika Dairies NZ Limited (“EDNZ”) from 63.4% to 72.3% vide a wholly-owned subsidiary, Etika (NZ) Limited through subscription of additional 1,936,768 new shares in the share capital of EDNZ pursuant to a rights issue exercise undertaken by EDNZ at the issue price of NZ$1 per share or a total subscription amount of NZ$1,936,768 on 27 February 2014.

April

Entered into conditional Sale & Purchase Agreement for proposed disposal of the dairies and packaging businesses and the relevant intellectual property to Asahi Group Holdings Southeast Asia Pte Ltd on 10 April 2014 for US$328,787,704.

Jun

Change of name of its wholly-owned subsidiary, Etika Beverages Sdn Bhd to Polygold Beverages Sdn Bhd with effect from 10 June 2014.

Increased issued and paid up capital in its wholly-owned subsidiary, Etika Vixumilk Pte Ltd from S$1 to S$11,446,056 on 20 June 2014.

Approval for the proposed disposal of dairies and packaging businesses to Asahi Group Holdings Southeast Asia Pte Ltd and change of company name were obtained at the EGM held on 20 June 2014.

Entered into Supplemental Sale & Purchase Agreement for proposed disposal of the dairies and packaging businesses and the relevant intellectual property to Asahi Group Holdings Southeast Asia Pte Ltd on 25 June 2014.

Completion of disposal of the dairies and packaging businesses and the relevant intellectual property to Asahi Group Holdings Southeast Asia Pte Ltd on 30 June 2014.

July

Acquisition of two shelf companies, Polygold Foods Sdn Bhd (“PFSB”) and Polygold Marketing Sdn Bhd (“PMSB”) by Etika Industries Holdings Sdn Bhd on 1 July 2014. The principal activity of PFSB is manufacturing of food products whereas PMSB’s principal activity is marketing and distribution of food and beverage products.

Change of company name of Etika International Holdings Limited to Envictus International Holdings Limited with effect from 15 July 2014.

Change of names of subsidiaries in Malaysia with effect from 16 July 2014 as follows:-

a) From Etika Foods (M) Sdn Bhd to Envictus Foods (M) Sdn Bhd

b) From Etika Industries Holdings Sdn Bhd to Polygold Holdings Sdn Bhd

Aug

Change of name of its wholly-owned subsidiary, Etika IT Services Sdn Bhd to Envictus IT Services Sdn Bhd with effect from 14 August 2014.

Sept

Acquisition of a shelf company, namely Glenland Sdn Bhd on 3 September 2014. Its principal activity is investment holding.

Oct

Acquisition of a shelf company, namely Gourmessa Sdn Bhd by Envictus Foods (M) Sdn Bhd on 1 October 2014. Its principal activity is manufacturing and distribution of convenient value-added frozen food.

Change of names of subsidiaries in New Zealand with effect from 23 October 2014 as follows:-

a) From Etika (NZ) Limited to Envictus NZ Limited

b) From Etika Dairies NZ Limited to Envictus Dairies NZ Limited

Nov

Change of name of subsidiaries as follows:-

a) From Etika Capital (Labuan) Inc. to Envictus Capital (Labuan) Inc. with effect from 29 October 2014

b) From Etika Foods International Inc.to Envictus Foods International Inc. with effect from 29 October 2014

c) From Etika Brands Pte Ltd to Envictus Brands Pte Ltd with effect from 11 November 2014

Jan

Completed allotment and issuance of additional 75,000,000 new ordinary shares in share capital of Etika International Holdings Limited at an issue price of S$0.21321 each to TYJFM for total consideration of S$15,990,750 on 7 January 2013.

Increased equity holding in Etika Dairies NZ Limited (“EDNZ”) from 60.7% to 63.4% vide a whollyowned subsidiary, Etika (NZ) Limited through subscription of additional 751,617 new shares in the share capital of EDNZ pursuant to a rights issue exercise undertaken by EDNZ at the issue price of NZ$1 per share or a total subscription amount of NZ$751,617 on 18 January 2013.

Opening of Texas Chicken (Malaysia) Sdn Bhd’s first flagship outlet at Aeon Bukit Tinggi Shopping Centre, a shopping mall located in Bandar Bukit Tinggi township, Klang on 31 January 2013.

Mar

Increased equity holding in Pok Brothers (Johor) Sdn Bhd from 81.8% to 100% vide a wholly-owned subsidiary of the Group, Pok Brothers Sdn Bhd for a consideration of approximately RM1.3 million on 25 March 2013.

July

Signed an International Multiple Unit Franchise Agreement with US-based Cajun Global LLC on 10 July 2012 for exclusive rights to develop and operate “Texas Chicken” restaurants in Malaysia and Brunei over next 10 years from 2013 to 2022.

Dec

Entered into a subscription agreement on 6 December 2012 and a supplemental subscription agreement on 24 December 2012 with Tee Yih Jia Food Manufacturing Pte Ltd (“TYJFM”), a leading frozen foods manufacturer in Singapore whereby Etika will allot and issue TYJFM 75,000,000 new ordinary shares at S$0.21321 each or a total consideration of S$15,990,750.

Jan

Completed the acquisition of 100% equity interest in Susu Lembu Group on 4 January 2011.

July

Completed the acquisition of balance 30% equity interest in PTSF and PTSB on 4 July 2011.

April

Completed the acquisition of 100% equity interest in TVX on 9 April 2010 for approximately USD9.0 million.

May

Signed syndicated financing facilities of RM368 million with a consortium of three leading Malaysian financial institution groups on 4 May 2010.

June

Entered into a conditional sale and purchase agreement for the proposed acquisition of 100% equity interest in Family Bakery Sdn. Bhd., Daily Fresh Bakery Sdn. Bhd. and Hot Bun Food Industries Sdn. Bhd. (“ Family Bakery Group”) on 4 June 2010 for a cash consideration of RM18.68 million.

July

Entered into a conditional sale and purchase agreement for the proposed acquisition of 100% equity interest in PT. Sentrafood Indonusa (“PTSF”) and PT. Sentraboga Intiselera (“PTSB”), an Indonesian instant noodle manufacturer and distributor on 5 July 2010 for an aggregate consideration of approximately Rp19.1 billion.

Entered into a conditional sale and purchase agreement for the proposed acquisition of 100% equity interest in Susu Lembu Asli (Johore) Sdn. Bhd. (“SLAJ”) and Susu Lembu Asli Marketing Sdn. Bhd. (“SLAM”), collectively known as “Susu Lembu Asli Group” on 19 July 2010 for a cash consideration of RM89.5 million.

October

Completed the acquisition of 100% equity interest in Family Bakery Group on 1 October 2010. Etika ventures into the manufacturing and distribution of fresh baked breads and buns.

Completed the acquisition of 70% equity interest in PTSF and PTSB on 6 October 2010, for an aggregate consideration of approximately Rp24.2 billion, marking the Group’s entry into the huge instant noodles industry.

Dato’

Jaya

J B Tan

Executive Chairman & Group Chief Executive Officer

Member of Nominating Committee

Yap Wai Ming

Independent Director

Chairman of Nominating Committee

Chairman of Remuneration Committee

Member of Audit Committee

Teo Siew Geok

Independent Director

Chairperson of Audit Committee

Member of Nominating Committee

Member of Remuneration Committee

Ng Siew Hoong

Independent Director

Member of Audit Committee

Member of Nominating Committee

Member of Remuneration Committee

SENIOR MANAGEMENT

Key Management

Dato’ Jaya J B Tan

Executive Chairman & Group Chief Executive Officer

Tan San Ming

Alternate Director to Dato’ Jaya J B Tan & Chief Operating Officer

Christine Yee Sau Cheng

Deputy Chief Financial Officer

Trading and Frozen Food Division

Dato’ Lawrence Pok York Keaw

Chief Executive Officer

Frozen Food Trading

Alan Pok York Keng

Chief Operating Officer

Food Services Division

Texas Chicken Malaysia

Tan San Yen

General Manager

Dairies Division

Ben Yeong Kwok Seng

Chief Operating Officer

Corporate Information

COMPANY SECRETARIES

S Surenthiraraj

Kok Mor Keat

REGISTERED OFFICE

SGX Centre II, #17-01

4 Shenton Way,

Singapore 068807

Telephone: (65) 6535 0550

Facsimile: (65) 6538 0877

SHARE REGISTRAR

Boardroom Corporate & Advisory Services Pte. Ltd.

I Harbourfront Avenue

Keppel Bay Tower

#14-03/07

Singapore 098632

INDEPENDENT AUDITORS

BDO LLP

Public Accountants and Chartered Accountants

600 North Bridge Road

#23-01 Parkview Square, Singapore 188778

Partner-in-charge: Ng Kian Hui

(Appointed since the financial year ended 30 September 2021)

PRINCIPAL BANKERS

Maybank Islamic Berhad

Malayan Banking Berhad

Bank Pertanian Malaysia Berhad

HSBC Amanah Malaysia Berhad

SOLICITORS

Morgan Lewis Stamford LLC